- Accessibility

- Request a Call Back

- Quick Drop CV

- Submit Timesheet

- About Us

- For Candidates

- For Clients

- News & Views

- Events

At Morgan Hunt, on the last day of January, we invited a group of Financial Directors from the Further Education (FE) College sector to join us and a great speaker to get a better insight from the Education and Skills Funding Agency (ESFA) into what they think the benchmark is for a financially successful college as well as the likely impact of the insolvency regime on the FE sector .

Matthew Atkinson

Director of Provider Market Oversight

Education & Skills Funding Agency

The speaker was Matthew Atkinson, Director of Provider Market Oversight, leading the Transactions Unit in the Education and Skills Funding Agency at the Department for Education. He spoke passionately on the subject and gave robust but clear advice to the group. His teams deliver and support (via investment) implementations of restructuring options developed in the Local Area Review process.

The team also oversee the provision of Exceptional Financial Support and carry out reviews on Sixth Form Colleges wishing to become Academies.

Post the Local Area Review and in light of the Special Insolvency Regime, he acknowledged that the Further Education sector is going through a challenging financial transition and the lack of a comprehensive review for this area of education has hampered its evolution. It is complicated with over 12,000 courses and 2,000 awarding bodies across the UK. Margins can be low, as colleges are capital intensive organisations with their regional markets having differing impacts on employer and student availability. This is especially the case in rural areas.

Please read on to pick up the key points here:

The EFSA is monitoring all FE colleges, but of course the level of scrutiny for colleges varies according to the level of financial risk in which a college finds itself. The body provides intervention with the best possible outcome in mind for the learners and the college. Many organisations have been in denial about their cash position and their ability to find a positive cashflow solution. This can vary due to colleges’ liabilities and the effect of the local employment area.

The team will look to reverse the set of conditions which put the college in a stressed financial position. So, the guidance is to seek advice early even if senior leadership prefer not to raise the alarm.

The main thrust of the discussion was that Further Education colleges would find a better way to financial success by preparing their annual financial forecast with their key audiences in mind: their learners and local employers who both benefit from a student’s academic success.

A key takeaway was that colleges are not selling courses, they are selling jobs! And therefore, it is extremely important to keep in touch with organisations in the local employment market to ensure there is demand for the skills the students will learn. The difference between colleges’ utilisation of assets such as real estate also provide different opportunities. The whole balance sheet needs to be considered as well as the profit and loss forecast.

Typically, the sector has made reference to historical data to determine future spend and demand. This has to change to forecasting that commences in October, which focuses on the education of 16 to 19 year olds as the core source of income. This allows for better commercial planning and market insight for the following academic year.

As with all forecasting there are pitfalls: the optimism bias of the Governors, the challenge of managing real estate to reduce costs or provide an income, and finally, acknowledging when the forecast highlights loss or a high need for cash. If a loss is forecasted, this is the time to approach the EFSA, not wait until the college has run out of money.

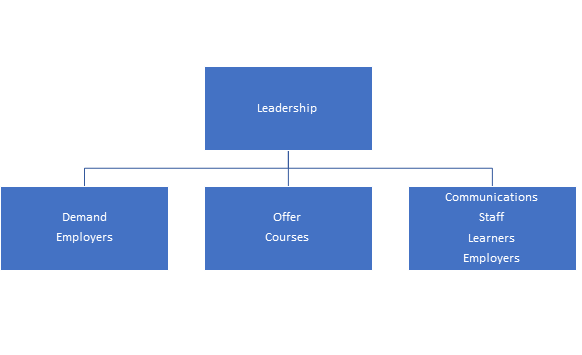

FE appears to be complicated but at the centre of its success, just as for any other independent organisation, is a business strategy. The simple formula to organise planning begins with good leadership. The leaders assess the demand both from Learners and Employers for the product which in the end is a job, create a compelling offer in the form of the curriculum and finally communicate the plan. Clearly communicating the organisation’s purpose, teaching aims and outcomes, to the key audiences of employees, learners and employers is vital.

Matthew advocated considering employing senior members of staff with commercial experience. Just as a Sales Director would consider building networks with local buying groups or influencing bodies, a college ought to map those routes to market. For instance, the local Chamber of Commerce, employers and schools will provide a great business barometer and promote the opportunities at the college.

Often missed is a consistent and clear communications plan. Once the financial and business planning is complete, the leadership must engage with its audiences to win hearts and minds for the plan and include teams to become ambassadors for the positive changes and opportunities at your college.

This phrase is used to highlight that business strategy runs from the business goals to the measures of success. For FE Colleges this relates to some key plans:

And the communications plan will enable the message stemming from these building block plans to define who you are, what you are good at and what you will become as an organisation.

Insolvency sounds bad – is it?

Members of Matthew’s team, including himself, have been Insolvency Practitioners. Insolvency sounds like failure to most people’s ears but at the heart of administration in this sector is the preservation of provision for existing learners.

Often for FE institutions the rescue plan has been pre-packaged by the EFSA and is delivered by the administrators after consultation with the college on the final deal. Re-brokerage is an option and common in this sector as unlike other institutions in the education sector, colleges have independent status. So although it is administrators working with a college team, they are carrying out the due diligence, not defining the outcome.

Mergers and acquisitions are becoming common for FE institutions but this too can be positive. Many can consolidate teaching staff, reallocate building use and ultimately create a much more compelling offer for employers and learners.

Whichever the proposed solution, closure is the last resort.

There are lots of income opportunities in this sector; the introduction of T-levels will offer a true alternative to the traditional routes to University, for example. But like all products, you need to have the operational strength and investment planned before rolling out the offer. Some courses such as those with digital or computing content may require capital expenditure for IT equipment and infrastructure – how could this be funded?

Colleges have lots of real estate; these are assets. Consider how else space can be reconfigured or an income derived from third parties.

In the end, the EFSA exist to aid the sector manage its finances to give good value to the UK tax payer. They look forward to working with colleges, they are clever and keen teams – get in touch!