- Accessibility

- Request a Call Back

- Quick Drop CV

- Submit Timesheet

- About Us

- For Candidates

- For Clients

- News & Views

- Events

Stress comes in many forms and can be caused by many factors, especially pressures at work.

Statistics from the Health and Safety Executive show that in the UK during 2017/18 roughly 600,000 workers suffered from some form of workplace related stress, depression or anxiety which led to a total 15.4 million working days lost in the same period.

The public sector is especially affected by these issues. Staff in education, human health, social work and public administration and defence on average experience higher rates of stress and mental health issues than any other industry (HSE, 2018).

The important first step to being able to manage your stress is to identify the cause. It could be the pressure of a specific project, difficulties with a colleague, having responsibilities that you find overwhelming or, inversely, you could feel that you don’t have enough work and aren’t experiencing change in your life. Whatever it is, take some time to reflect on your personal situation.

Once you know why you’re stressed you’re in the best position to be able to resolve it.

Here are 5 tips to help you manage your stress:

This article contains public sector information published by the Health and Safety Executive and licensed under the Open Government Licence. Also contains public sector information published by the NHS.

The announcement of the appointment of Darren Montagu to the Board of Morgan Hunt as the newly appointed Chief Strategy Officer comes at a time when Morgan Hunt’s core markets face the challenge of an increasingly competitive environment for attracting the best talent.

Darren joined Morgan Hunt on 3rd April 2019, having already been engaged on an interim basis, providing support to the senior leadership team.

Prior to this appointment, Darren spent 27 years working for Hays plc. His career at Hays saw him starting as a trainee recruiter, eventually joining the Hays board as Managing Director of Scotland and Northern Ireland as well as the South East of England. Other highlights of his career include the opening of a Hays business in Holland and building their offering to the Energy markets more broadly.

Daniel Taylor, Managing Director of Morgan Hunt, commented “I am delighted to have Darren on board. All those who have worked with him will know of his acute knowledge of recruitment businesses and his ability to inspire and drive exceptional performance. His arrival builds on a very positive 18 months for the company and will apply focus to the ambitious goals we have set for the business to achieve over the next four years.”

Darren Montagu said “After a long and rewarding career with Hays, it’s a big personal decision for me to move to Morgan Hunt. I am fortunate to have worked at Hays and been part of an outstanding group of professionals with a shared belief that it’s the people we employ that are the most important element of a successful recruitment company.”

“My new colleagues at Morgan Hunt remind me of exactly why I invested my career in recruitment. They have the vision, ambition and talent to leverage an already trusted brand to explore growth opportunities from existing operations and through acquisition, as well as attracting like-minded individuals to join us.” added Montagu.

At Morgan Hunt, on the last day of January, we invited a group of Financial Directors from the Further Education (FE) College sector to join us and a great speaker to get a better insight from the Education and Skills Funding Agency (ESFA) into what they think the benchmark is for a financially successful college as well as the likely impact of the insolvency regime on the FE sector .

Matthew Atkinson

Director of Provider Market Oversight

Education & Skills Funding Agency

The speaker was Matthew Atkinson, Director of Provider Market Oversight, leading the Transactions Unit in the Education and Skills Funding Agency at the Department for Education. He spoke passionately on the subject and gave robust but clear advice to the group. His teams deliver and support (via investment) implementations of restructuring options developed in the Local Area Review process.

The team also oversee the provision of Exceptional Financial Support and carry out reviews on Sixth Form Colleges wishing to become Academies.

Post the Local Area Review and in light of the Special Insolvency Regime, he acknowledged that the Further Education sector is going through a challenging financial transition and the lack of a comprehensive review for this area of education has hampered its evolution. It is complicated with over 12,000 courses and 2,000 awarding bodies across the UK. Margins can be low, as colleges are capital intensive organisations with their regional markets having differing impacts on employer and student availability. This is especially the case in rural areas.

Please read on to pick up the key points here:

The EFSA is monitoring all FE colleges, but of course the level of scrutiny for colleges varies according to the level of financial risk in which a college finds itself. The body provides intervention with the best possible outcome in mind for the learners and the college. Many organisations have been in denial about their cash position and their ability to find a positive cashflow solution. This can vary due to colleges’ liabilities and the effect of the local employment area.

The team will look to reverse the set of conditions which put the college in a stressed financial position. So, the guidance is to seek advice early even if senior leadership prefer not to raise the alarm.

The main thrust of the discussion was that Further Education colleges would find a better way to financial success by preparing their annual financial forecast with their key audiences in mind: their learners and local employers who both benefit from a student’s academic success.

A key takeaway was that colleges are not selling courses, they are selling jobs! And therefore, it is extremely important to keep in touch with organisations in the local employment market to ensure there is demand for the skills the students will learn. The difference between colleges’ utilisation of assets such as real estate also provide different opportunities. The whole balance sheet needs to be considered as well as the profit and loss forecast.

Typically, the sector has made reference to historical data to determine future spend and demand. This has to change to forecasting that commences in October, which focuses on the education of 16 to 19 year olds as the core source of income. This allows for better commercial planning and market insight for the following academic year.

As with all forecasting there are pitfalls: the optimism bias of the Governors, the challenge of managing real estate to reduce costs or provide an income, and finally, acknowledging when the forecast highlights loss or a high need for cash. If a loss is forecasted, this is the time to approach the EFSA, not wait until the college has run out of money.

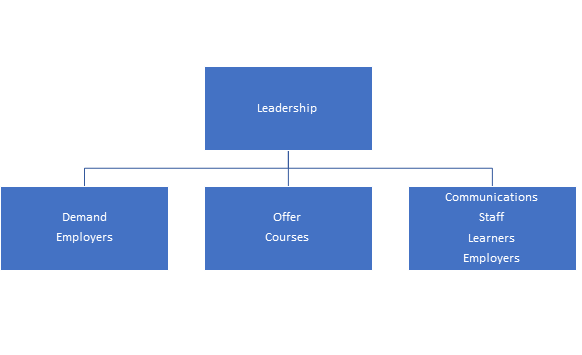

FE appears to be complicated but at the centre of its success, just as for any other independent organisation, is a business strategy. The simple formula to organise planning begins with good leadership. The leaders assess the demand both from Learners and Employers for the product which in the end is a job, create a compelling offer in the form of the curriculum and finally communicate the plan. Clearly communicating the organisation’s purpose, teaching aims and outcomes, to the key audiences of employees, learners and employers is vital.

Matthew advocated considering employing senior members of staff with commercial experience. Just as a Sales Director would consider building networks with local buying groups or influencing bodies, a college ought to map those routes to market. For instance, the local Chamber of Commerce, employers and schools will provide a great business barometer and promote the opportunities at the college.

Often missed is a consistent and clear communications plan. Once the financial and business planning is complete, the leadership must engage with its audiences to win hearts and minds for the plan and include teams to become ambassadors for the positive changes and opportunities at your college.

This phrase is used to highlight that business strategy runs from the business goals to the measures of success. For FE Colleges this relates to some key plans:

And the communications plan will enable the message stemming from these building block plans to define who you are, what you are good at and what you will become as an organisation.

Insolvency sounds bad – is it?

Members of Matthew’s team, including himself, have been Insolvency Practitioners. Insolvency sounds like failure to most people’s ears but at the heart of administration in this sector is the preservation of provision for existing learners.

Often for FE institutions the rescue plan has been pre-packaged by the EFSA and is delivered by the administrators after consultation with the college on the final deal. Re-brokerage is an option and common in this sector as unlike other institutions in the education sector, colleges have independent status. So although it is administrators working with a college team, they are carrying out the due diligence, not defining the outcome.

Mergers and acquisitions are becoming common for FE institutions but this too can be positive. Many can consolidate teaching staff, reallocate building use and ultimately create a much more compelling offer for employers and learners.

Whichever the proposed solution, closure is the last resort.

There are lots of income opportunities in this sector; the introduction of T-levels will offer a true alternative to the traditional routes to University, for example. But like all products, you need to have the operational strength and investment planned before rolling out the offer. Some courses such as those with digital or computing content may require capital expenditure for IT equipment and infrastructure – how could this be funded?

Colleges have lots of real estate; these are assets. Consider how else space can be reconfigured or an income derived from third parties.

In the end, the EFSA exist to aid the sector manage its finances to give good value to the UK tax payer. They look forward to working with colleges, they are clever and keen teams – get in touch!

In the past 12 months, the ramifications of both domestic and international politics have created a tsunami of uncertainty, anger, fear and division.

Is there any wonder why? We have been hit with a barrage of headlines about the dire predictions for the UK economy including;

“Pretty grim reading”

“Two decades of lost earnings growth”

“Declining living standards”

“The endless living squeeze”

Throwing in the mix about Brexit threatening to move your jobs to mainland Europe, the rise of Artificial Intelligence, plastic pollution and the all the other horror stories. The idea of hiding under the bed with Moz, the John Lewis monster seems most appealing.

However, there are grounds for optimism especially if you are fledgling accounts trainee, newly qualified or an established and seasoned accountant.

Singularly the biggest issue facing Professional Service clients who are recruiting is not the competition. It is not unrealistic salary demands but it is the ongoing skills shortage amongst candidates particularly around Audit / Assurance / Tax / Advisory / Risk and Insolvency.

Demand for accounting staff has remained consistent throughout the year and will continue into 2018. We do not hear from our clients about the imminent collapse of the UK economy. Far from it. The expectation is a push on hiring next year.

The question to ask job seekers should be, what are you doing to make your profile stand out? what skills do you need to develop? where can you focus your efforts to secure your next role? How are you approaching your job search?

For those employers out there, the message from the UK working population is very clear. The drip feed for improved flexibility and work life balance driven by the millennials is now matched by all generation types.

It is by far the biggest motivator for job change. Money, reward and career development is following closely behind. The thinking is; if purchasing a house is a distant dream and materialism and the requirement for “things” less important, life experiences and time to enjoy them is the compensation.

A business with innovative ideas, working flexibly with clear objectives whilst operating as an achievement focused meritocracy is an easy and compelling sell.

So, accepting change, embracing it and leading change for candidates and clients alike is the optimistic message as Christmas and a New Year approaches. Time for calm and hold of nerves, panic is no use to anyone.

Knowing when it’s time to find a new job. Whether we are especially happy with our current role or not, mostly we are passive job seekers. That is, we are not actively looking for new jobs but might consider a position if we were offered one and its terms were attractive. Yet there is a point at which we decide that we are no longer satisfied with the current state of affairs and become active job seekers.

This usually entails actively searching online jobs portals for suitable roles, rewriting our CVs, getting them out there and speaking to recruiters. There are several scenarios that tend to tip us from one category into the other, some of which are rational and some of which are emotional.

We describe four types that may tip the balance:

It sounds self-evident that you would be looking for work if you are not currently employed, but this is not always the case. People who have been out of work for a period of time can become very daunted by the application process and lose their confidence, and it can be difficult to get out of this mindset. The best thing to do in this situation, if you have prior experience, is to speak to a recruiter (like Morgan Hunt) and get some advice and reassurance about what kind of role you should look for and how to get your confidence back.

Many changes in our personal lives can affect our approach to work. If you have just had a child, have suffered a protracted illness or are nearing retirement age you may want to work less hours and find that you are more suited to a part-time role. You may find that you would prefer a less stressful line of work or you may feel that you want to increase your earnings and go for a role that is more challenging but provides you with better prospects and financial rewards.

The first two reasons aside, this is the one that tends to motivate people to look elsewhere. If your current role is going nowhere, you are unlikely to get a promotion and you’re not enjoying your work enough to make up for this, then you should certainly think about looking elsewhere. You may even find that the elusive promotion you’ve been waiting for suddenly turns up when you get offered a role somewhere else, so it’s always worth considering your options every few years or so.

Sometimes people work in a particular sector or for a single company for many years and decide they want to do something completely different with their life. This is becoming more and more common as people tend to change jobs more often in any case, and there is nothing to be said against it aside from the fact that if you do decide to make this kind of move you should ensure you have the necessary skills or qualifications, or you could find yourself in a tight spot.

This is now more common than you think. There is no longer any shame attached to redundancy but it can certainly catapult you from being a passive job seeker into an active one.

If the redundancy is voluntary then clearly there is a decision involved on your part. Its important to remember that when being made redundant you are entitled to a redundancy package, and this can often be quite generous so not only can it give you the opportunity for a change in career it may also give you some breathing space to think about what you want from your next role and to prepare your CV to match this. Most people walk out of a redundancy all for the better.

If you’d like to discuss why and when it’s best to start re-thinking your career path, get in touch with our recruitment experts here at Morgan Hunt.

Are you a champion of causes and want a career that gives as good as it gets?If you’re the person getting behind the latest cause, have a way with words and the ability never to take no for an answer then working for a charity could be the perfect career for you. Paid charity work can cover nearly every career option from marketing and public relations to policy and hr, and comes with a healthy dose of job satisfaction. Not sure where to start? We’ve got you covered.

What they do

Feverishly generate cash to ensure the smooth operation of the charity’s work. A hands on role where you can be expected to recruit individuals, groups and organisations to the cause through planned sales activities.

What you need

Excellent communication and social skills are an absolute essential. If going out and meeting new people is not your thing then this might not be the job for you. Being able to talk to anyone from celebrities at a party to the head of a company is crucial to success, not to mention being a team player. Unbridled creativity and tenacity are all factors of a successful fundraiser.

Earning potential

Initial salary may start at around £20,000 or so for fundraisers just starting out, rising to well over £30,000 for management positions.

Perfect for

People who want to forge a career in the charity sector.

What they do

Support the charity in improving visibility of the cause & brand building, usually includes public relations, copywriting, event organisation, campaign management and a range of other tasks.

What you need

As with most marketing roles, creativity is key. Drive, ingenuity and the ability to work well under pressure are all definite strengths when looking to work in marketing.

Earning potential

Depending on experience you can usually look to earn between £20 -£25,000 and upwards.

Perfect for

People who appreciate good advertising campaigns.

What they do

Plan organise and promote a range of events, from bake sales through to fashion shows and more. If you’re the life and soul of the party then working in events is the job for you.

What you need

You’ll be representing and reflecting your charity at all times, so the ability to maintain effective relationships with donors as well as excellent planning & organisational skills are absolutely essential. There are no specific qualifications needed to become an Event Manager but experience throwing parties helps.

Earning potential

Starting salary can be around £18,000 rising to above £20,000 with additional experience.

Perfect for

People who love putting on a show.

Visualise the job you want

The first step is the hardest step. Set your goals. If the end goal is a stretch too far at this point, break it down into realistic and achievable steps.

Know your abilities

Be honest about your strengths and weaknesses, brutally honest, know where you are in relation to your goal, but don’t let this put you off. You’re on a journey and that journey may take you onto some ‘B’ roads before you hit the highway.

Get hands on

Experience can be vital to break into the charity sector. If you’re just starting out, work experience and internships are both great ways to begin your journey. Entry level positions are also achievable with some transposable skills.

Talk to someone who is where you want to be

Find someone doing what you want to do. Now that you have a role model ask yourself what is it about them that has made them successful. Maybe sit and have a coffee with them and talk about their career journey. Find out their secrets-of-success. You will find that people are often more than happy to talk about themselves and offer this key information quite freely.

Connect with others

Build connections with people who can help you. Join communities and professional networks – these may be specific functional groups or skill specific associations. Build a LinkedIn profile. Be relevant to their conversations and be prepared to hold your own opinions. It’s important to share your passion but stay on piste and develop an antenna to tamper down when necessary.

Brush-up on your knowledge

Keep abreast of your profession, read sector related magazines and journals attend events and talk to people in commerce to get a fresh and up-to-date perspective.

Finally...

Passion and ambition is infectious. Your drive and energy will elevate you to stand out in the crowd. Be generous with your ideas and treat others how you wish to be treated yourself.

The Morgan Hunt fundraising team has extensive experience in connecting great candidates with exciting vacancies for charities, not-for-profit, education and arts and heritage organisations. Contact us by calling the team on 0207 419 8900 to find out more.